when does current estate tax exemption sunset

Currently the estate tax. A uses 9 million of the available BEA to reduce the gift tax to zero.

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

Projections for the post-sunset.

:max_bytes(150000):strip_icc()/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

. A dies in 2026. By Jack Aguillard. Unless your estate planning is.

Effective January 1 2022 no Ohio estate tax is. Fast-forward to 2026 and the estate and gift tax exemption amounts will sunset unless otherwise extended by Congress and the president. One of the biggest changes well see with the tax rates sunsetting in 2026 involves the estate tax.

Therefore if Congress does not. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years. When the calendar turns to 2026 the estate tax provisions implemented by the Tax Cuts and Jobs Act TCJA are due to expire or sunset.

After 2025 the exemption amount will sunset a fancy way of. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. The TCJA is set to sunset at the end of 2025.

Significant Changes Regarding Estate Tax. As a note the current exemption rules will sunset in 2026 to an amount that is roughly half the current amount. With the federal gift and estate tax lifetime exemption amount currently set to sunset and return to pre-Tax Cuts and Jobs Act levels in.

Fast-forward to 2026 and the estate and gift tax exemption amounts will sunset unless otherwise extended by Congress and the president. However this threshold is slated to sunset in 2026 to half of its then-current level. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018.

Starting January 1 2026 the exemption will return to 549 million. In 2018 when the BEA is 1118 million A makes a taxable gift of 9 million. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability.

Accordingly estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estategift tax exemption available in 2021 should it disappear. Projections for the post-sunset. All of these funds would also be removed from their estate for estate tax purposes.

Ohio Estate Tax Sunset Provision 2021 The Ohio Estate Tax was repealed effective January 1 2013 and a sunset provision has been added. Notably the TCJA provision that doubled the gift. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

However the TCJA will sunset on. Federal Estate Tax Exemption Sunset Is Not Far Off Merhab Robinson Clarkson Law Corporation Will The Lifetime Exemption Sunset On January 1 2026 Agency One Sunrise. Unless Congress acts in the interim for those dying in 2026 or later the threshold will be 68.

The 117m per person gift and estate tax exemption will. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. The current estate tax exemption is set to expire at sunset in 2025 at which time it could revert to the pre-2018 exemption level of 5 million for an individual taxpayer.

After that the exemption amount will drop back down to the prior laws 5 million cap. Even if the BEA is lower that.

The Coming Estate Tax Storm Erskine Erskine

Estate Tax Current Law 2026 Biden Tax Proposal

The Tax Cuts And Jobs Act Key Changes And Their Impact Bny Mellon Wealth Management

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

The Winds Of Change Are Blowin Pallas Capital Advisors

Estate Tax Portability Election Extended Virginia Cpa

The Generation Skipping Transfer Tax A Quick Guide

A New Era In Death And Estate Taxes

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Sunset Provision For Social Security And Medicare Part 2 Hauptman And Hauptman Pc

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

As The Tax Law Sunset Nears Review Savvy Gifting Solutions

Watching The Sunset Current Estate Tax Laws Vs New Proposals Bdf Llc Bdf

Creating Estate Tax Plans Under The Biden Administration

Create An Estate Plan Now To Take Advantage Of Big Tax Exemption

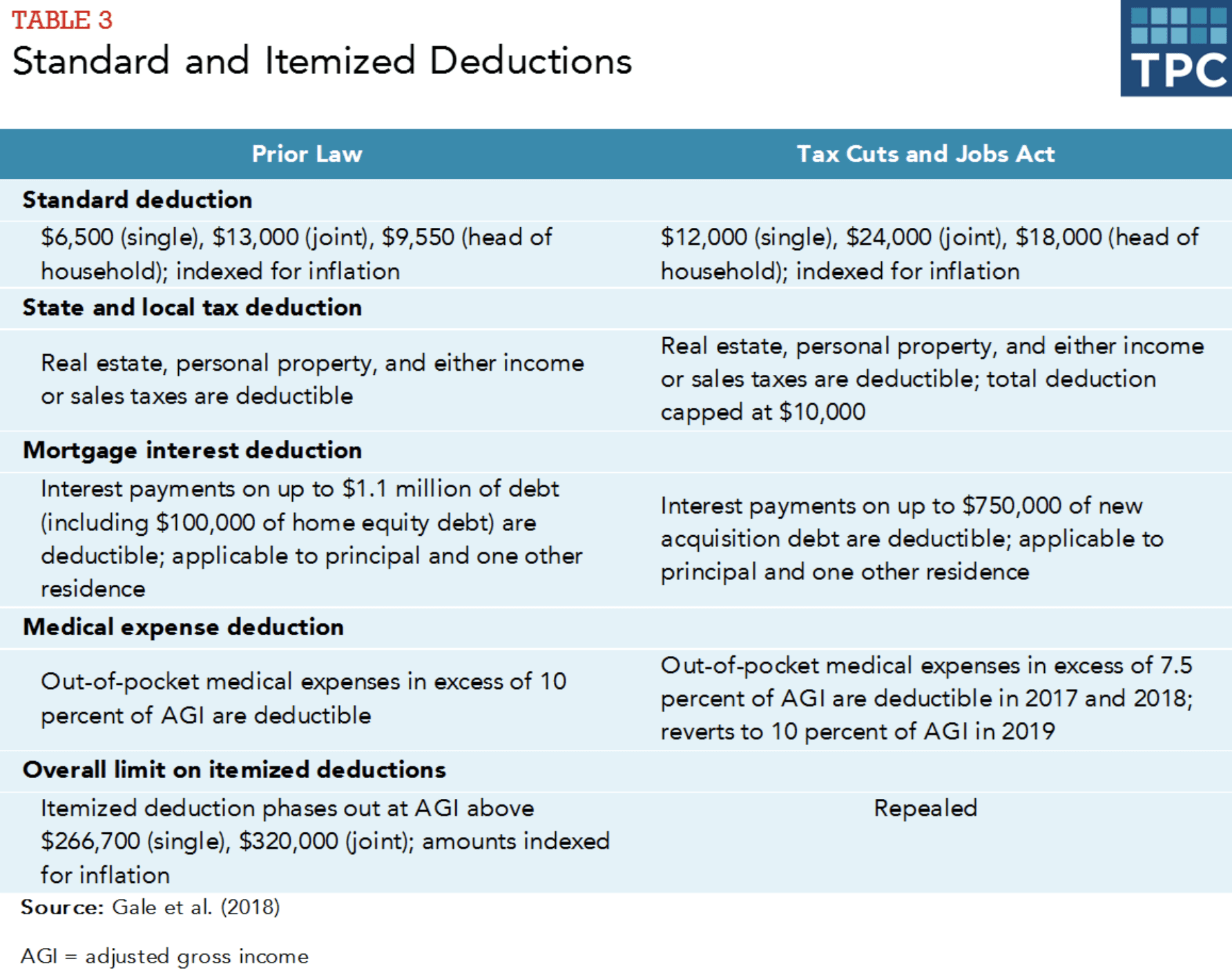

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Will The Lifetime Exemption Sunset On January 1 2026 Agency One